straight life policy calculator

As the name suggests its in a particular straight line thus it can be said that it uses. A 7702 plan is a tax-advantaged life insurance policy and is named based on the Internal Revenue Code that spells out how cash value life insurance policies retain their tax-advantaged status.

Limited Pay Whole Life Insurance Comprehensive Guide To The Best Policies With Sample Rates

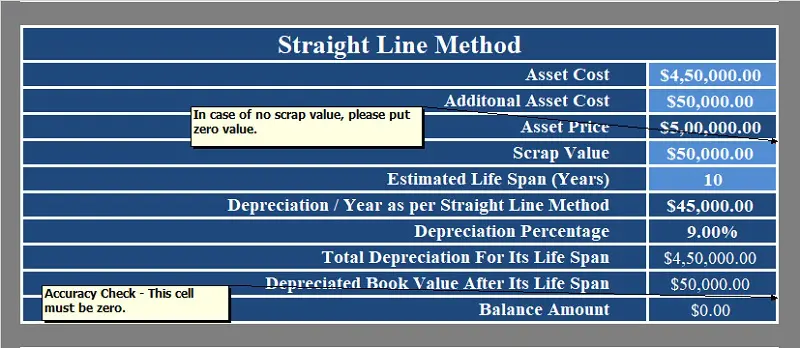

With this method depreciation is calculated equally each year during the useful life of the asset.

. If youre looking for a mens jacket input your height and the width of your chest. Now lets look at a type of life insurance called term life insurance aka pure life insurance that guarantees a death benefit if you the insured die during a period of time you specify the term. For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000.

Calculate the depreciation rate ie 1useful life. Select the type of coverage Sum Assured. The Midpoint Formula is given as.

The Hearts Desire Number often referred to as the Soul Urge Number is derived from the VOWELS in your FULL Birth Name. Whole life insurance or whole of life assurance in the Commonwealth of Nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date. That means we sell policies we dont underwrite them Theres no shortage of companies out there offering fast or easy insurance coverage but we think a marketplace is the best way to compare them all and Policygenius combines that marketplace experience with online tools an expansive.

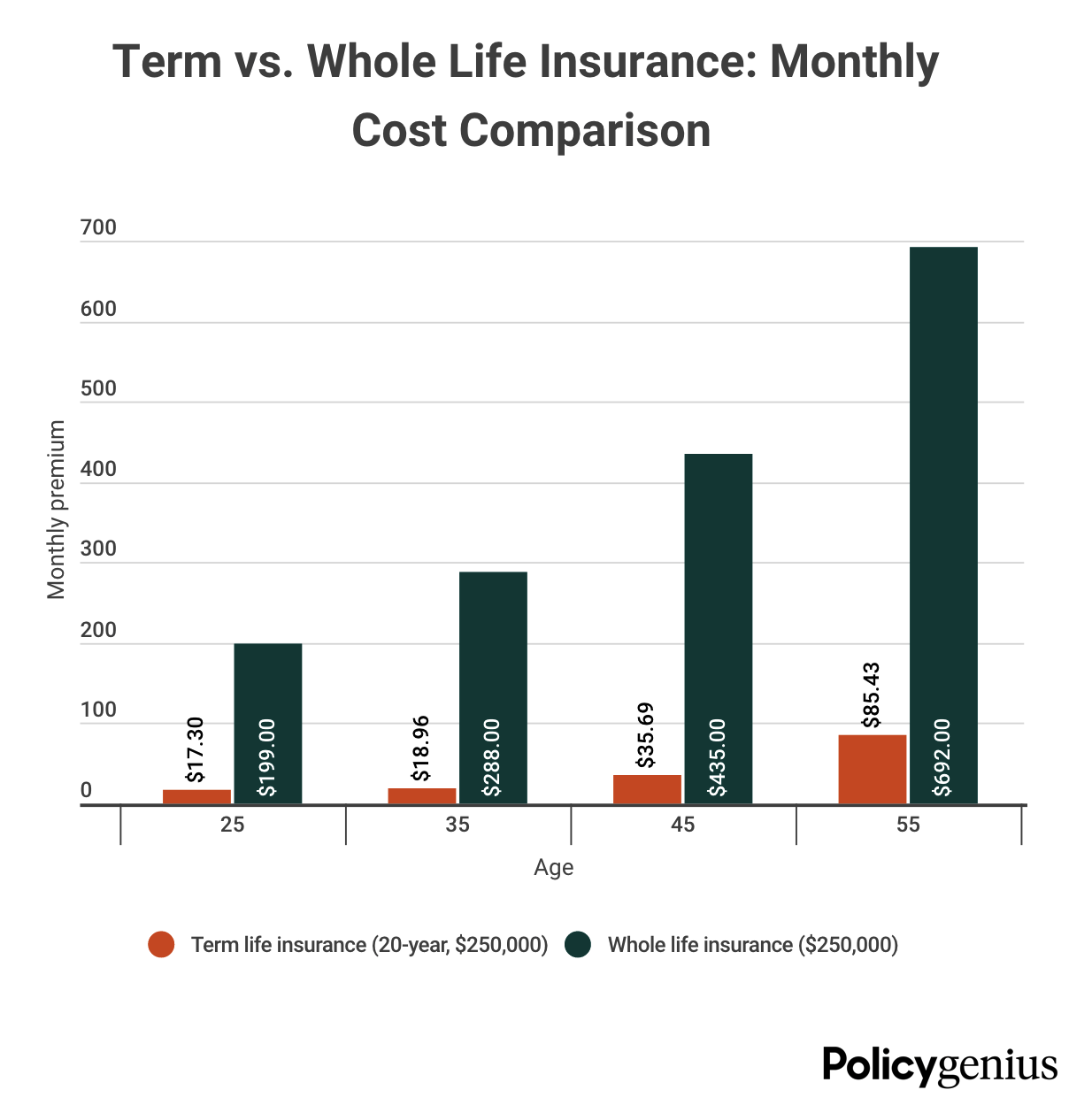

Determine the useful or functional life of the asset. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the Double Declining Balance MethodUse this calculator for example for depreciation rates entered as 15 for 150 175 for 175 2 for 200 3 for 300 etc. Heres how much annual premiums compare for a 500000 policy of term life insurance vs.

Motion in a straight line is nothing but linear motion. Learning about your Hearts Desire Number can reveal the general intentions behind many of your actions your true motivations inner cravings and urges and your likes and dislikes. After a few interactions I realized I was chatting with the same real person every time which made the process very smooth.

If you die after the term is over the insurance company doesnt pay. The process was straight forward. First one can choose the straight line method of depreciation.

The best way to get the answers is to understand the process. The jacket size calculator will combine the information you provided to return your jacket size at. The value is used to determine annual depreciation in.

Another important thing to know about term life insurance is that it has no cash value. If an object changes its position with respect to its surroundings with time then it is called in motion. Looking straight you should be looking at the top third part of the screen.

5 Questions Newlyweds Have About Life Insurance. Your monitor should be tilted a bit like 10-20. In a VUL the cash value can be invested in a wide variety of separate accounts similar to mutual funds and the choice of which of the available separate accounts to use is entirely up to the contract ownerThe variable component in the name refers to this ability to invest in.

It provides a couple different methods of depreciation. Dont forget about proper lighting. Its also important that your elbows and underarms lie straight on the table and armrests.

Variable universal life insurance often shortened to VUL is a type of life insurance that builds a cash value. Shout out to the excellent customer service who responded promptly to more than a dozen questions I had. Haven Term is a Term Life Insurance Policy DTC 042017 and ICC17DTC in certain.

Salvage value is the estimated value that the owner is paid when the item is sold at the end of its useful life. For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

Using this calculator should be no trouble - its a simple and intuitive tool. What is Motion in a Straight Line. Read more ie the value at which the asset can be sold or disposed of after its useful life is over.

Many a life insurance company in India provide quotes online thus allowing you to choose a life insurance policy ie the best. With all of that being said take a look at this list of life stages to see if life insurance is the right choice for you. However when it comes to life insurance is a one-million-dollar life insurance policy.

As a life insurance policy it represents a contract between the insured and insurer that as long. Use this calculator to calculate an accelerated depreciation of an asset for a specified period. 465 - 48 in.

Other than those rare and awesome situations where someone has finished off the Baby Steps and become both debt-free and self-insured most people need to have a life insurance policy in place. It is a change in the position of an object over time. Spend time to research about life insurance in India to make an informed choice on alife insurance company.

Policygenius is an insurance marketplace not an insurance company. Life Insurance Needs Calculator. Suppose the endpoints of the line are x 1 y 2 and x 2 y 2 then the midpoint is calculated using the formula given below.

To find the midpoint of the straight line in a graph we use this midpoint formula that will enable us to find the coordinates of the midpoint of the given line. Many exciting elements make up life as a newlywed especially when youre just coming off the thrill of a wedding and honeymoon. All you need to do is.

If you need a womens jacket put in your chest and hip measurements. Try to have a 90-110 angle at the elbow. This depreciation calculator is for calculating the depreciation schedule of an asset.

What Is A Straight Life Policy Bankrate

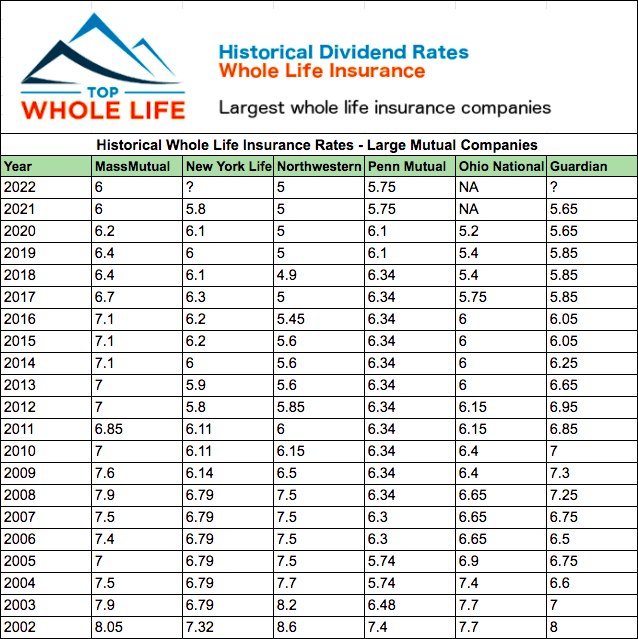

Find Top 7 Whole Life Insurance Companies For Cash Value In 2022

Facebook Advertising Opportunity Calculator Wordstream

Compare Life Insurance Quotes And Policies August 2022 Nerdwallet

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Double Declining Balance Depreciation Calculator

The 7 Types Of Life Insurance Policies What S The Best One For You

Term Life Vs Whole Life Insurance Policygenius

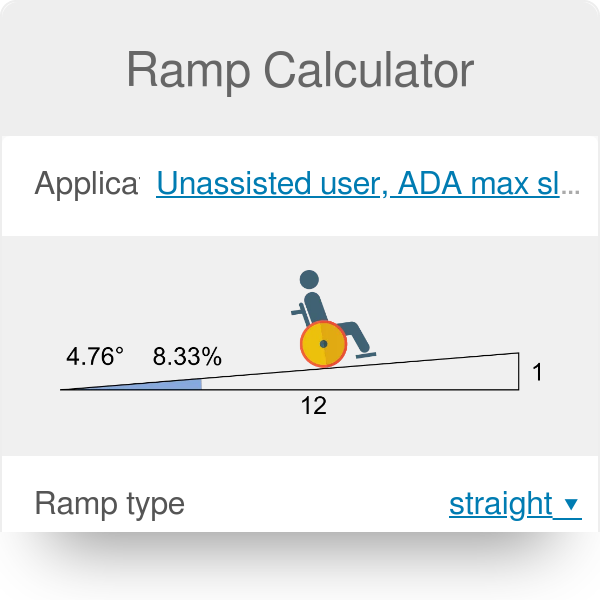

Ramp Calculator Ada Ramp Standards More

What Is Whole Life Insurance The Motley Fool

Loss Ratio Formula Calculator Example With Excel Template

Annual Growth And Cagr Getting Your Growth Rates Straight Small Business Trends

Whole Life Insurance Quotes Smartasset Com

Download Depreciation Calculator Excel Template Exceldatapro

Whole Life Insurance Quotes Smartasset Com

Insurance Calculators Nerdwallet

Download Depreciation Calculator Excel Template Exceldatapro

Whole Life Insurance What It Is And How It Works 2022

What Is Whole Life Insurance And How Does It Work Lincoln Heritage